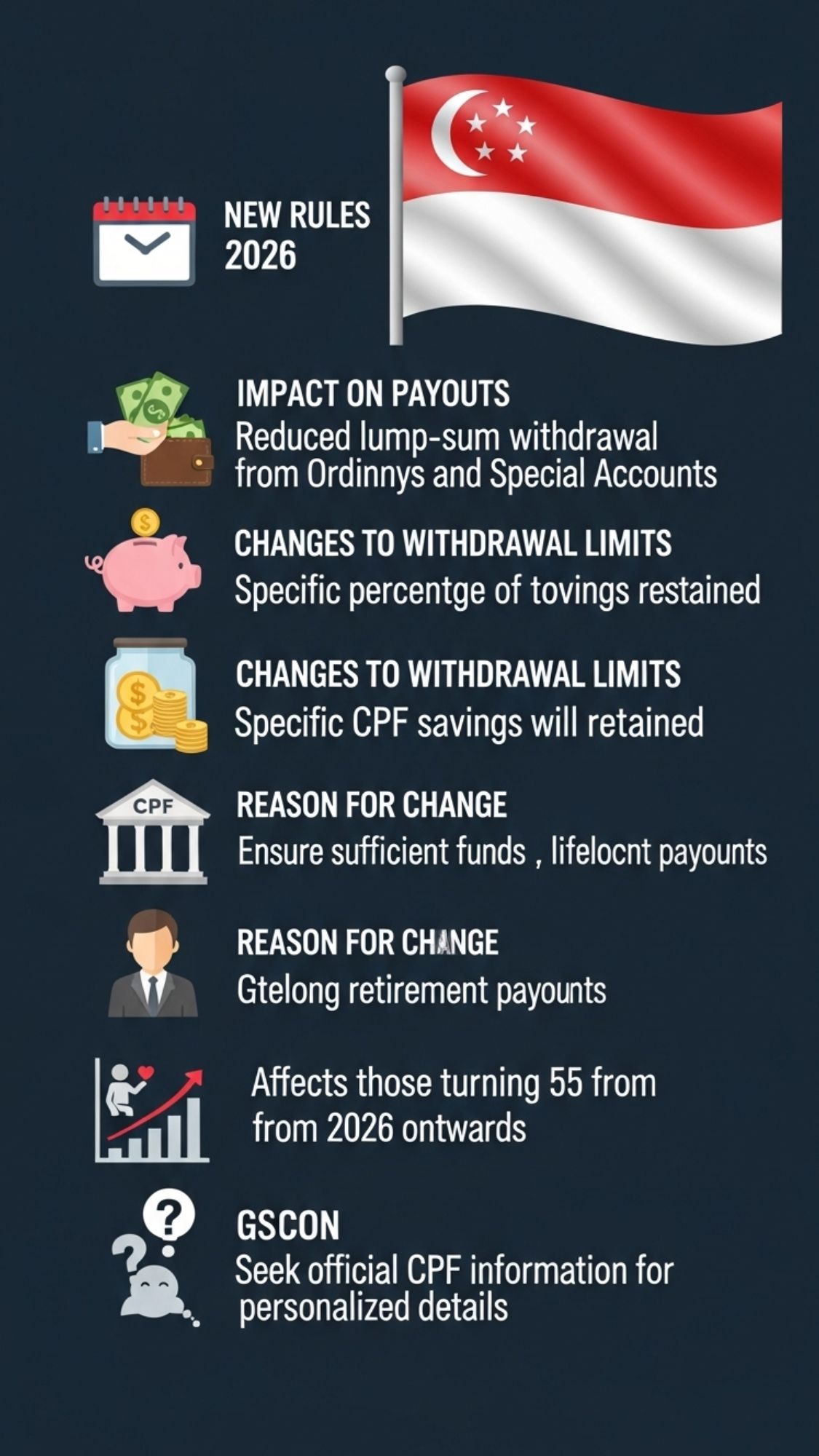

When you turn fifty-five years old you reach an important milestone in your CPF journey. This marks a significant point after many years of building up your retirement savings. In 2026 the Singapore CPF system will introduce several important updates designed to strengthen retirement security while providing more flexibility. These new rules cover various aspects whether you want to take a special holiday or increase your monthly retirement income. The changes reflect the government’s ongoing effort to help Singaporeans prepare better for their retirement years. Understanding these updates is essential for anyone approaching retirement age or planning their financial future. The modifications aim to balance the need for accessible funds with the importance of maintaining adequate retirement savings throughout your later years.

Establishment Of The RA Account At Age 55: The Age Of Withdrawability

The RA account starts when you reach fifty-five years old. According to the new CPFALS Rules your existing OA and SA balances will then be measured against the Full Retirement Sum (FRS). Starting in mid-January 2026, a new change will close the SA for anyone turning 55. The money in your SA will be used to top up your RA until it reaches the FRS so you can earn higher long-term interest and receive better payouts. Any remaining SA funds will be transferred to your OA where you can withdraw them anytime. Everyone can withdraw at least $5,000 in cash without any conditions. This amount can increase based on several factors that may allow you to keep more funds available up to the FRS level.

Retirement Sums 2026 Snapshot

The amounts will go up each year to account for inflation & longer life expectancy. For people who turn 55 in 2026 the retirement sums are as follows:

| Retirement Sum Category | Required Amount (S$) | Primary Objective | Estimated CPF LIFE Monthly Payout (From Age 65) |

|---|---|---|---|

| Basic Retirement Sum (BRS) | 106,500 | Covers essential daily living needs (housing excluded) | Approximately $900 – $1,000 per month |

| Full Retirement Sum (FRS) | 213,000 | Supports a more stable and comfortable retirement lifestyle | Approximately $1,600 – $1,700 per month |

| Enhanced Retirement Sum (ERS) | 426,000 | Provides higher lifelong payouts through voluntary top-ups | Around $3,300 per month |

Special Schemes For Property Owners

If you own a Singapore property that will last until you are 95 years old then pledging it could cover half of the Full Retirement Sum while keeping the Basic Retirement Sum in cash. This allows you to withdraw more money from your Retirement Account beyond the Basic Retirement Sum amount. When you eventually sell the property you need to repay the total CPF principal plus interest. This option works well for property owners who need access to their retirement funds but do not have enough cash savings available.

Other Scenarios Of Withdrawal

You can access your funds if a doctor confirms you have less than twelve months to live & your balance exceeds $5000 with proper medical documentation. The account closes permanently when foreign nationals depart the country for good regardless of their citizenship status. The minimum age requirement stays at 55 years without any modifications. The main challenge remains finding the right balance between covering current expenses and preserving enough money for retirement.