A New Chapter for Singapore’s Seniors Picture yourself at sixty-five with decades of experience behind you and plenty of energy left for what comes next. Maybe you want to keep working at something you enjoy or perhaps explore opportunities you never had time for before. In Singapore where people now live past 83 on average, retirement doesn’t mean stepping away from everything. It means choosing how you want to spend the extra years you’ve been given. The government has recognized this shift and by December 2025 will have introduced policies that reflect these changing realities. These measures aim to help older workers stay engaged while making sure they have the protection they need. Singapore’s approach acknowledges a simple truth: people are living longer & many want to remain productive. The new policies create a framework that supports this desire without forcing anyone into a one-size-fits-all solution.

Singapore’s Current Retirement Threshold in 2025: What Workers Reach Today

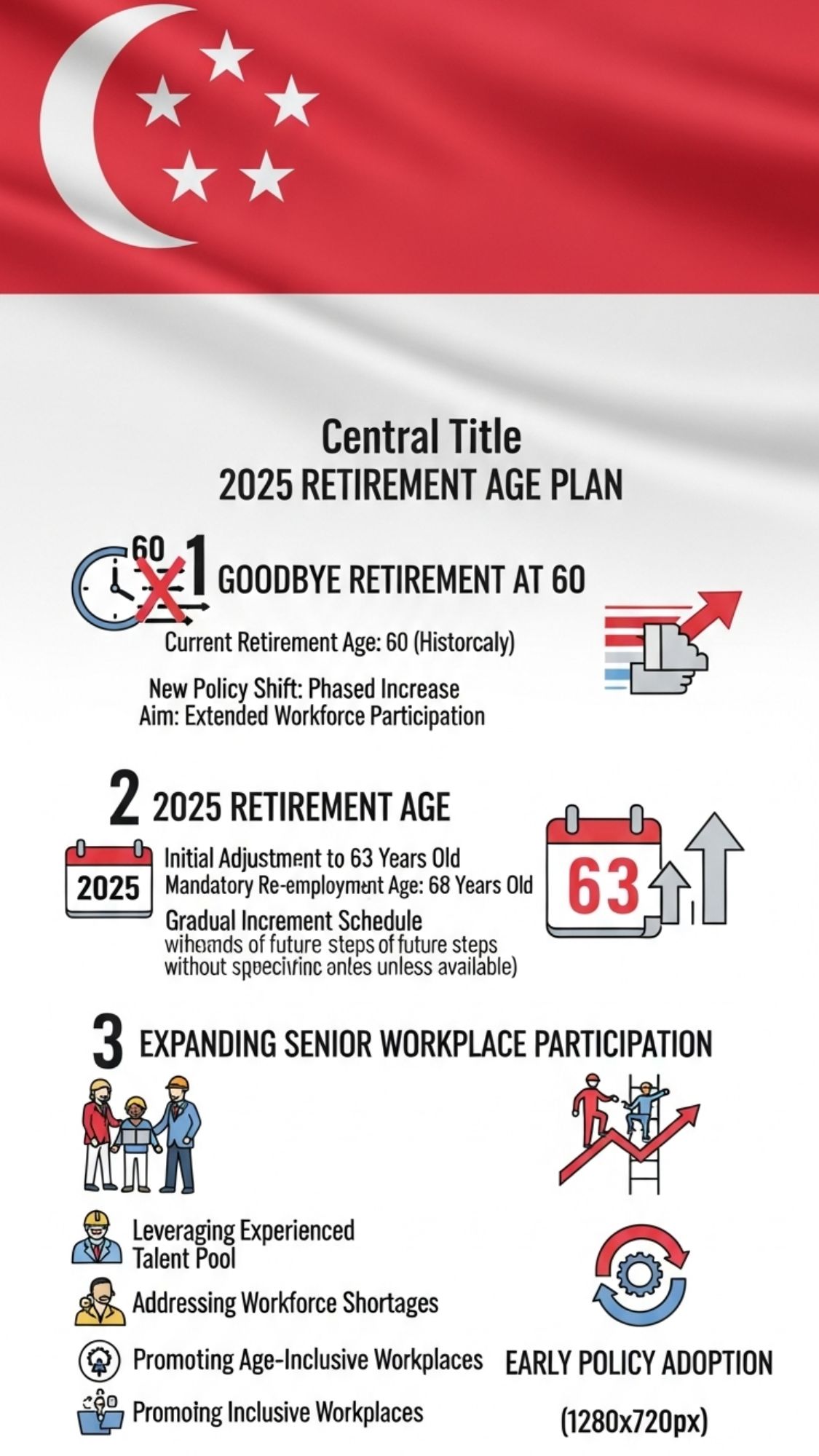

The legal retirement age in Singapore is 63 years old. Employers cannot dismiss workers just because of their age before they reach this milestone. This rule protects older employees & helps businesses benefit from experienced staff members. The Ministry of Manpower enforces these regulations strictly. Many older workers decide to continue working longer because they need financial stability and want to stay active in Singapore’s fast-paced economy.

Policy Shifts Ahead: How Singapore Plans to Lift the Retirement Age

Good news arrives in 2026 with upcoming workplace changes. Starting July 1st the retirement age will increase to 64 while the re-employment age shifts from 68 to 69. This step-by-step strategy aligns with future goals to reach a retirement age of 65 and a re-employment age of 70 by 2030. The public sector will lead these changes by putting them into practice from July 2025 onward. These updates address both Singapore’s aging population and workforce needs. As people enjoy longer and healthier lives, giving them the choice to work longer becomes both practical and beneficial for everyone involved.

Working Beyond Retirement: Re-Employment Pathways for Senior Employees

Re-employment serves as a pathway for individuals who wish to continue working. Employees who meet specific criteria including medical fitness & satisfactory job performance receive employment offers that extend until they reach the re-employment age. The terms of employment may be adjusted with possibilities such as reduced working hours or alternative job roles. However the fundamental objective remains centered on mutual benefit for both parties. When employers lack available positions within their organization they are required to provide reasonable support such as job placement assistance to help these workers find suitable opportunities elsewhere.

Retirement Age vs CPF Withdrawal Age: Key Differences Explained

The common belief that retirement age directly links to Central Provident Fund (CPF) payments is actually incorrect. These two systems operate independently. CPF payment eligibility begins at 65 when monthly payouts through CPF LIFE start providing lifelong financial security. Meanwhile withdrawals become possible from age 55 but only amounts exceeding the required retirement sum can be taken out. This separation gives workers flexibility to continue working if they want while still having access to their available funds.

How Singapore’s Retirement Age Has Evolved Over the Years

Retirement and Re-employment Ages in Singapore The table below shows the current retirement and re-employment ages that apply in Singapore.

| Implementation Phase | Statutory Retirement Age | Maximum Re-Employment Age |

|---|---|---|

| Present Policy (2025) | 63 years | 68 years |

| Policy Shift from July 2026 | 64 years | 69 years |

| Long-Term Target by 2030 | 65 years | 70 years |

Why the New Retirement Age Benefits Both Employers and Older Workers

The extension of CPF contributions through these policies helps ensure people have enough retirement savings. Older workers can live meaningful lives by using their skills & earning income. Companies retain valuable expertise that matters to their operations while the government provides financial support through programs like Senior Employment Credits. This approach builds a dynamic and welcoming workforce where age becomes an advantage instead of a barrier.